10 Essential Steps for Successful Financial Planning

Financial planning is a crucial aspect of securing one's financial future, regardless of where you live. However, in a bustling city like Melbourne, where the cost of living can be high, effective financial planning becomes even more vital. Whether you're a resident of Melbourne or planning to move there, understanding the essential steps for successful financial planning can help you achieve your long-term financial goals while navigating the unique economic landscape of the city.

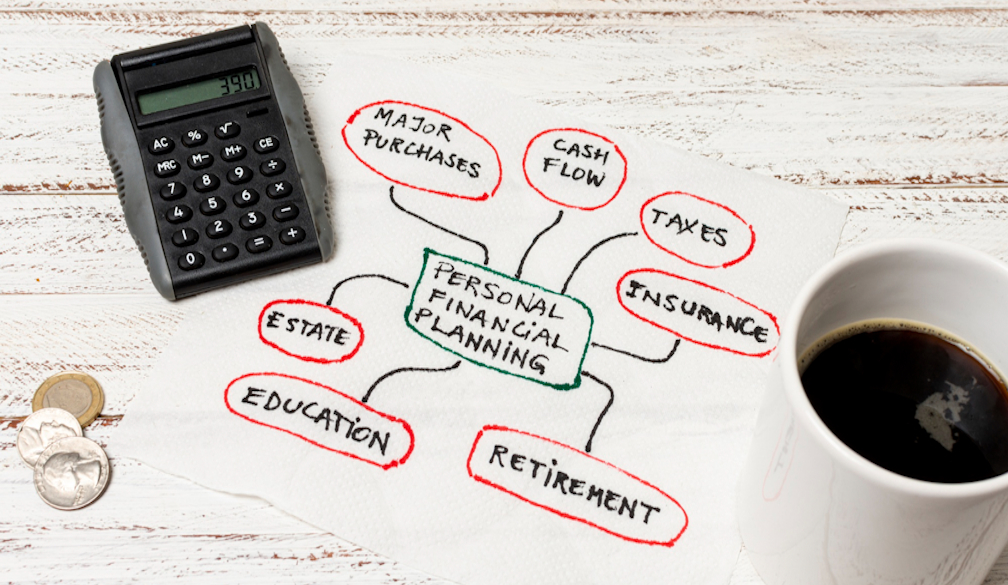

Define Your Goals:

The first step in financial planning is to clearly define your short-term and long-term financial goals. Whether it's buying a house in Melbourne's suburbs, saving for retirement, or starting a business, having specific goals allows you to tailor your financial plan accordingly.

Assess Your Current Financial Situation:

Take stock of your current financial situation, including your income, expenses, assets, and debts. Understanding where you stand financially provides a solid foundation for developing an effective financial plan.

Create a Budget:

Developing a budget is essential for managing your finances effectively. In Melbourne, where living expenses can vary greatly depending on factors like location and lifestyle, creating a detailed budget can help you allocate your resources wisely and avoid overspending.

Build an Emergency Fund:

Unexpected expenses can arise at any time, so it's crucial to have an emergency fund to fall back on. Aim to save enough to cover three to six months' worth of living expenses to provide a financial safety net in case of job loss, medical emergencies, or other unforeseen circumstances.

Manage Debt:

Debt can be a significant obstacle to financial stability, so it's essential to develop a plan to manage and reduce it. Prioritise paying off high-interest debt first while making minimum payments on other debts to avoid accumulating more interest.

Save for Retirement:

Investing in your retirement is key to ensuring financial security in the future. Take advantage of retirement savings options available in Melbourne, such as employer-sponsored retirement plans or individual retirement accounts (IRAs), and contribute regularly to build a substantial nest egg.

Invest Wisely:

Developing an investment strategy tailored to your risk tolerance, time horizon, and financial goals is crucial for long-term wealth accumulation. Consider seeking advice from a financial advisor in Melbourne to help you navigate the complexities of investing and build a diversified portfolio.

Protect Your Assets:

Insurance plays a critical role in protecting your assets and mitigating financial risks. Whether it's health insurance, life insurance, or property insurance, make sure you have adequate coverage to safeguard your finances against unexpected events.

Review and Adjust Your Plan Regularly:

Financial planning is not a one-time task but an ongoing process. Review your financial plan regularly to track your progress towards your goals and make any necessary adjustments based on changes in your life circumstances or the economic environment.

Seek Professional Guidance:

Navigating the intricacies of financial planning can be daunting, especially in a dynamic city like Melbourne. Consider seeking guidance from a qualified financial planner who understands the local market and can help you develop a personalised financial plan tailored to your needs and goals.