Securing Your Future Through Financial Planning

Financial planning is the cornerstone of building a secure future. It involves a systematic approach to managing finances to achieve life goals. Whether it's buying a home, saving for retirement, or funding your children's education, effective financial planning provides a roadmap for success. In this article, we delve into the importance of financial planning in Melbourne, Australia, and explore its significance.

Understanding Financial Planning

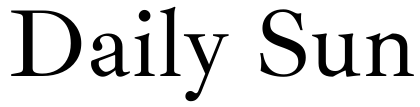

Financial planning encompasses a range of activities aimed at managing resources efficiently to meet short-term and long-term goals. It involves assessing current financial status, setting objectives, and devising strategies to achieve them. This process typically includes budgeting, saving, investing, insurance planning, tax planning, and retirement planning. By aligning financial resources with individual goals, financial planning enables individuals to make informed decisions and navigate through life's uncertainties.

The Importance of Financial Planning

- Goal Setting: Financial planning begins with defining specific and achievable goals. Whether it's buying a house, starting a business, or retiring comfortably, setting clear objectives provides direction and motivation.

- Risk Management: Life is unpredictable, and financial planning helps mitigate risks by establishing emergency funds, purchasing insurance, and diversifying investments. This ensures financial stability in the face of unexpected events like job loss, illness, or market downturns.

- Wealth Accumulation: Through disciplined saving and strategic investing, financial planning facilitates wealth accumulation over time. By harnessing the power of compounding, individuals can grow their assets and achieve financial independence.

- Tax Optimisation: Effective tax planning is integral to financial success. By understanding tax laws and leveraging tax-efficient investment vehicles, individuals can minimise tax liabilities and maximise returns, thereby preserving wealth.

- Retirement Planning: Planning for retirement is essential to maintain a comfortable lifestyle in old age. Financial planning helps individuals estimate retirement needs, create retirement income streams, and ensure a smooth transition into retirement.

Financial Planning in Melbourne

As one of Australia's major financial hubs, Melbourne boasts a thriving financial planning industry. With a diverse population and a strong economy, the city offers a plethora of financial services tailored to individuals' unique needs.

- Expertise and Accessibility: Melbourne is home to a vast network of financial planners with expertise in various domains, including investment management, retirement planning, estate planning, and wealth preservation. These professionals provide personalised advice and solutions to clients, ensuring their financial goals are met.

- Regulatory Framework: The financial planning industry in Melbourne operates within a robust regulatory framework designed to protect consumers' interests. Financial planners must adhere to strict licensing requirements and ethical standards set by regulatory bodies such as the Australian Securities and Investments Commission (ASIC) and the Financial Planning Association of Australia (FPA).

- Tailored Solutions: Financial planners in Melbourne understand the unique financial landscape and challenges faced by residents. Whether it's navigating the property market, optimising superannuation investments, or planning for education expenses, they offer tailored solutions to address clients' specific needs and goals.

- Holistic Approach: In line with global trends, financial planners in Melbourne emphasise a holistic approach to financial planning. They consider factors such as lifestyle preferences, risk tolerance, and family dynamics to develop comprehensive financial strategies that align with clients' values and aspirations.

- Community Engagement: Melbourne's financial planning community actively engages with the public through seminars, workshops, and educational initiatives aimed at promoting financial literacy and empowering individuals to take control of their financial future.

Conclusion

Financial planning is a dynamic process that empowers individuals to achieve their life goals and secure their financial future. In Melbourne, Australia, the vibrant financial planning industry provides residents with access to expert advice, tailored solutions, and a supportive community. By embracing financial planning principles and leveraging professional expertise, individuals can navigate through life's milestones with confidence and peace of mind.